Understanding the guidance in IFRS 16 on accounting for lease modifications by both lessees and lessors.

From the IFRS Institute – August 30, 2019

Companies have been busy implementing the new leases standard (IFRS 16), with a particular focus on transition and the Day 1 accounting. Although companies may have dealt with lease modifications at transition, modifications that take place after transition are a key ‘Day 2’ aspect of the new standard for both lessees and lessors. Lease modifications are common and accounting for them can be complicated. In this article, we outline the lease modification guidance in IFRS 16, compare it to US GAAP, and describe the lessee and lessor accounting for common types of lease modifications.

IFRS 16 defines a lease modification as “a change in the scope of a lease, or the consideration for a lease, that was not part of the original terms and conditions of the lease.” A lease modification results from renegotiations between the lessee and lessor. Example lease modifications include (but are not limited to):

Often, more than one modification will occur simultaneously – e.g. reducing building space subject to a lease, while simultaneously extending the term of the lease for the remaining space. Lease modifications are defined similarly under US GAAP. 1

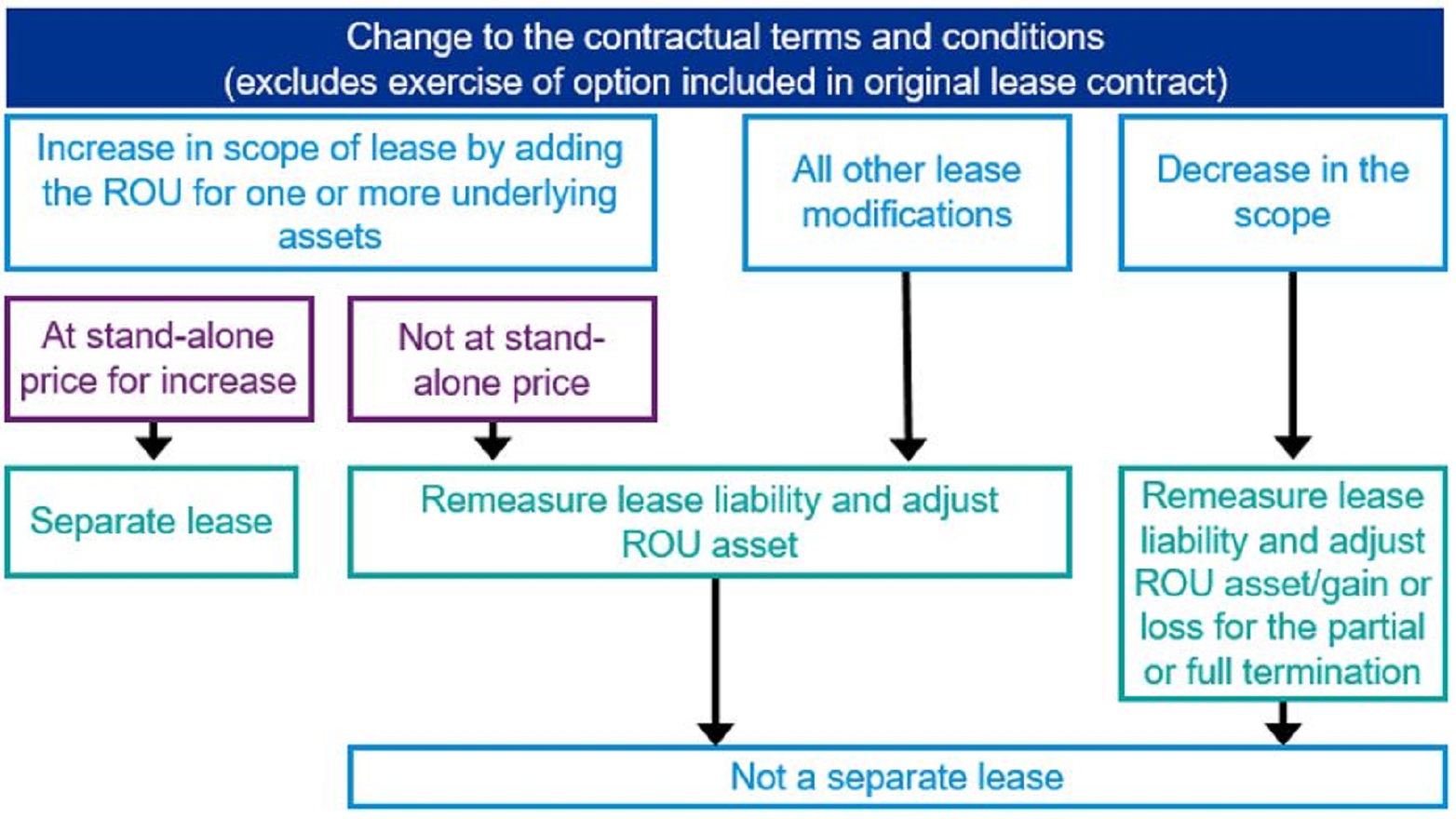

The starting point for a lease modification is to assess whether it creates a separate lease. A lessee accounts for a lease modification as a separate lease if both of the following conditions exist:

A modification that only increases the lease term on the existing underlying asset(s) does not meet the first condition because it does not grant the lessee the right to use one or more additional underlying assets.

Example – Increase in scope with corresponding increase in consideration

Lessee LE entered into a lease with Lessor LR to lease one floor in an office building for 10 years. LE’s business has since expanded and LE now requires additional office space. At the beginning of Year 6, LE and LR agree to amend the contract to grant LE the right to use an additional floor of office space in the same building for 5 years. The lease payments for the additional office space are $100,000 per year, which is commensurate with the market rental price for similar office space.

The lease of the additional office space was not part of the original terms and conditions of the contract. Therefore, this is a lease modification. This modification increases the scope because it grants LE the right to use an additional floor of office space. Because the lease payments for the additional right of use are commensurate with the market rental price for similar office space leases (i.e. equivalent to the stand-alone price for the increase in scope), LE accounts for this modification as a separate lease.

In a different scenario, assume that the annual lease payments remained unchanged from the original lease or were increased by an amount that was not commensurate with the stand-alone price for the additional office space (e.g. $50,000 per year). In those cases, the modification would not be accounted for as a separate lease.